HOW TO MAKE A WINNING OFFER ON YOUR NEXT HOME!

Monday, March 22, 2021 at 11:50AM

Monday, March 22, 2021 at 11:50AM

An article i read from Freedie Mac gives sound direction on making an offer on a home. From the start, it emphasizes how trusted professionals can help you stay focused on the most important things, especially at times when this process can get emotional for buyers:

“Remember to let your homebuying team guide you on your journey, not your emotions. Their support and expertise will keep you from compromising on your must-haves and future financial stability.”

As a real estate professional, I feel it is very important to be the expert guide you lean on for advise when you’re ready to make an offer.

2. Understand Your Finances

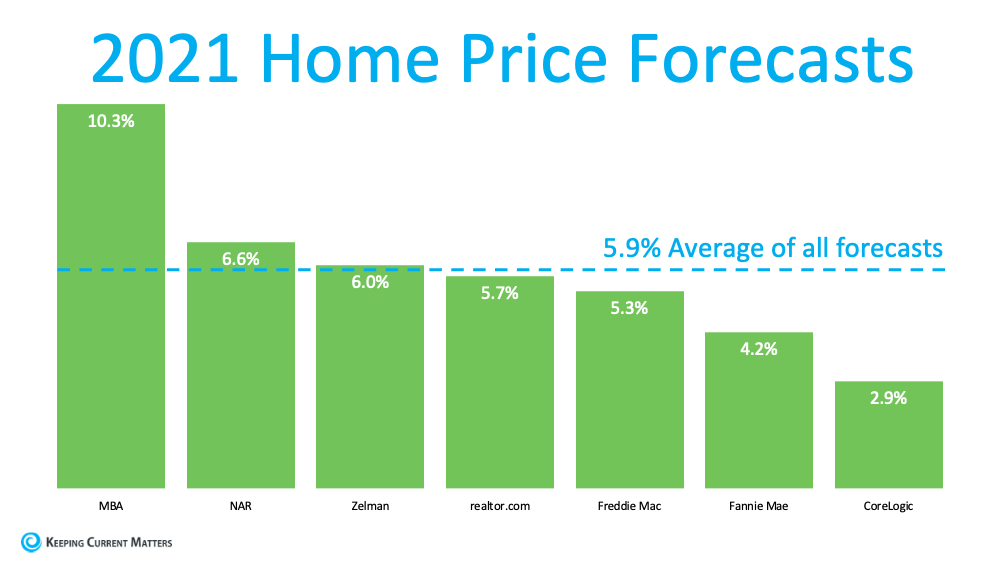

Having a complete understanding of your budget and how much house you can aford is essential. The best way to know this is to get pre-approved for a loan early in the homebuying process. Only 44% of today’s prospective homebuyers are planning to apply for pre-approval, so be sure to take this step so you stand out from the crowd. Doing so makes it clear to sellers you’re a serious and qualified buyer, and it can/will give you a competitive edge in a bidding war.

3. Be Prepared to Move Quickly

According to the latest Realtors Confidence Index from the National Association of Realtors (NAR), the average property sold today receives 3.7 offers and is on the market for just 21 days. These are both results of today’s competitive market, showing how important it is to stay agile and alert in your search. In my local market homes are active for 3-7 days prior to hearing offers. Most homes are receiving 2-8 offers depending on their price point. So, as soon as you find the right home for your needs, be prepared to submit an offer as quickly as possible.

4. Make a Fair Offer

It’s only natural to want the best deal you can get on a home. However, submitting an offer that’s too low can lead sellers to doubt how serious you are as a buyer. Don’t make an offer that will be tossed out as soon as it’s received. The expertise your agent brings to this part of the process will help you stay competitive and psooibly win the house!

5. Stay Flexible in Negotiations

After submitting your offer, the seller may accept it, reject it, or counter it with their own changes. In a competitive market, it’s important to stay nimble throughout the negotiation process. You can strengthen your position with an offer that includes flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). There are, however, certain contingencies you don’t want to forego. Resist the temptation to waive the inspection contingency. Without that very important Inspection contingency, you could get stuck in contract with a home you cant afford to fix!

Today’s competitive market makes it more important than ever to make a strong offer on a home. Reach out to your local real estate professional to make sure you rise to the top along the way. Feel free to call, text or email me anytime for help finding your dream home or selling your existing home to find your next dream! 925-330-3878 / stevepoirier@pacbell.net